Climate Change Crisis

Commitment

Aiming to achieve Net Zero by 2050, Thai AirAsia has set goals to progressively intensify its environmental management policy on a yearly basis.

The Company’s policies, operations and adoption of new technologies and know-how are all geared towards minimising and controlling the greenhouse gas emissions (GHG) into the atmosphere.

Net Zero Strategy

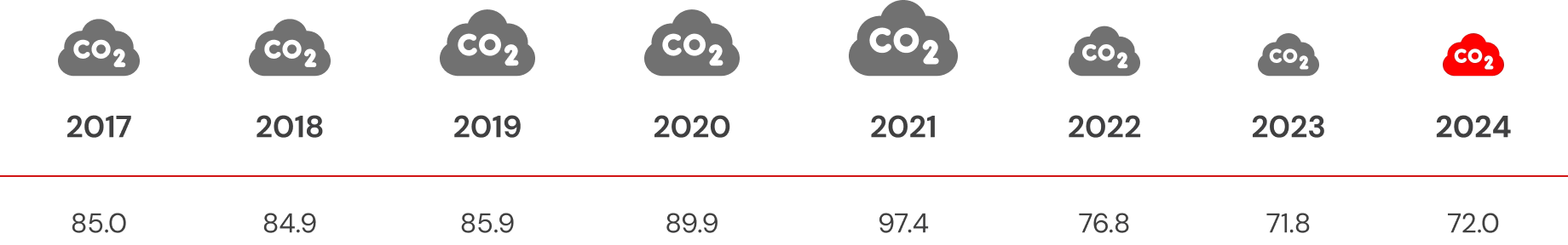

The Company continues to work towards the same short-term objective, which was set in 2022: bringing down the amount of carbon dioxide emissions per revenue passenger kilometre to 3 gCO2/RPK.

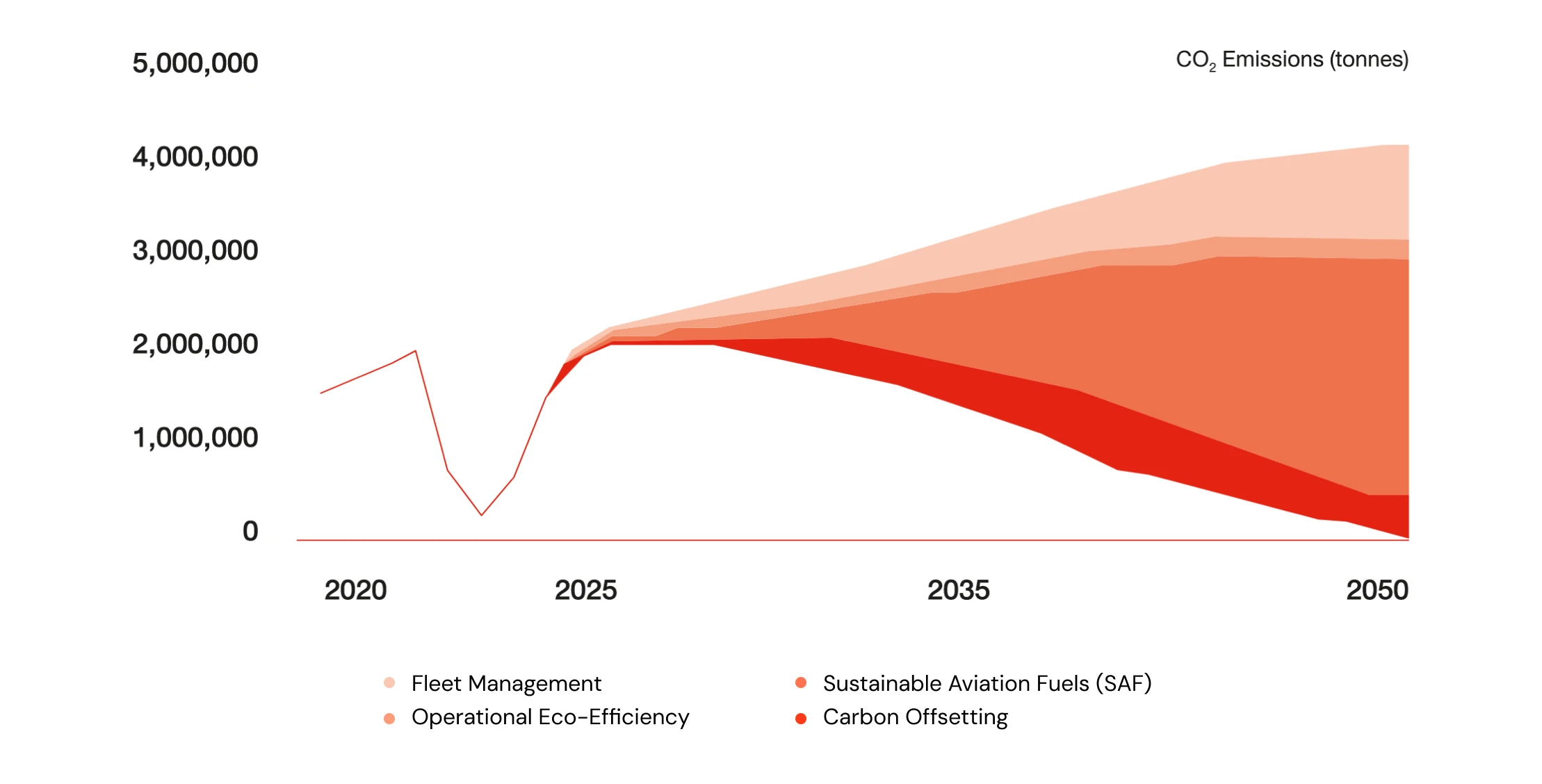

In 2024, the Company targeted 68.8 gCO2/RPK of carbon dioxide emissions per revenue passenger kilometre. The rate for the year was 72 gCO2/RPK, 0.2 gCO2/RPK higher than the target. Increased CO2 emissions were due to the aviation industry's post-COVID recovery, leading to more air travel. Flight restrictions caused higher fuel consumption per flight, while the need to fly at higher altitudes due to global warming also increased fuel use. Additionally, more frequent storms and unpredictable weather necessitated longer routes and circling, further impacting fuel consumption. The Company has established the following four initiatives in order to achieve its long-term goal of reaching net zero greenhouse gas emissions, or Net Zero, by 2050 includes:

Short-Term Goal

Long-Term Goal

Roadmap Towards Net Zero by 2050

Figure : Thai AirAsia’s pathway to net zero by 2050. CO2 emissions for years 2018-2022 are based on actual data. Figures for 2023 onwards are based on AirAsia Aviation Group Limited’s projections.

1. Fleet Renewal

The resumption of new A321neo aircraft deliveries for AirAsia Group in 2024 enabled AirAsia to leverage fleet management as a second important pathway to decarbonisation.

The newer model aircraft is equipped with a 236-seat cabin, adding 56 seats while consuming 15-20% less fuel than its predecessor. The seat configuration allows for an at least 20% reduction in the carbon intensity ratio when compared to current A320 aircraft. The newer planes are also equipped with lightweight seats by Mirus Aircraft Seating which lessen the weight of each A320 by 287 kg and A321neo by 375 kg compared to older seat models. Each new aircraft is pre-installed with software that allows implementation of our advanced fuel efficiency programme.

Thai AirAsia is scheduled to receive three to five of these aircraft to replace our existing fleet until complete in 2035. The Company received three of the newer model aircraft this year and ended 2024 with a total five A321neo aircraft.

2024 Fleet Distribution

A320ceo

A320neo

A321neo

2. Operational Efficiency

Thai AirAsia’s fuel efficiency programme underpins our emissions reduction efforts. The Company tries to maintain the lowest carbon intensity measures as much as possible through continuous efforts to reduce fuel consumption, both to lower our operational costs and carbon footprint.

The Company apply over fifteen green operating procedures with the main ones mentioned below:

Operational Eco-Efficiency

The Average amount of Reduced CO2 from each Procedure

Our Pilots Fly “Safe and Save”

Data: 2024

3. Sustainable Aviation Fuel

Adoption of Sustainable Aviation Fuel (SAF) in the place of JET A-1 fuel to further reduce carbon emissions. SAF is a biofuel that provides an alternative to fossil fuels. Appropriately proportioned usage of SAF can reduce carbon emissions by 80% compared to Jet A-1 fuel. However, due to SAF costing approximately three times that of traditional fuel options, It has yet to significantly airlines using SAF for commercial domestic flights. Studying data provided by the manufacturer of the Airbus 320 aircraft, which make up the majority of the Thai AirAsia fleet, the Company found that the planes can accommodate SAF at a proportion of 50%.

4. Acquisition of Carbon Offsetting Credits

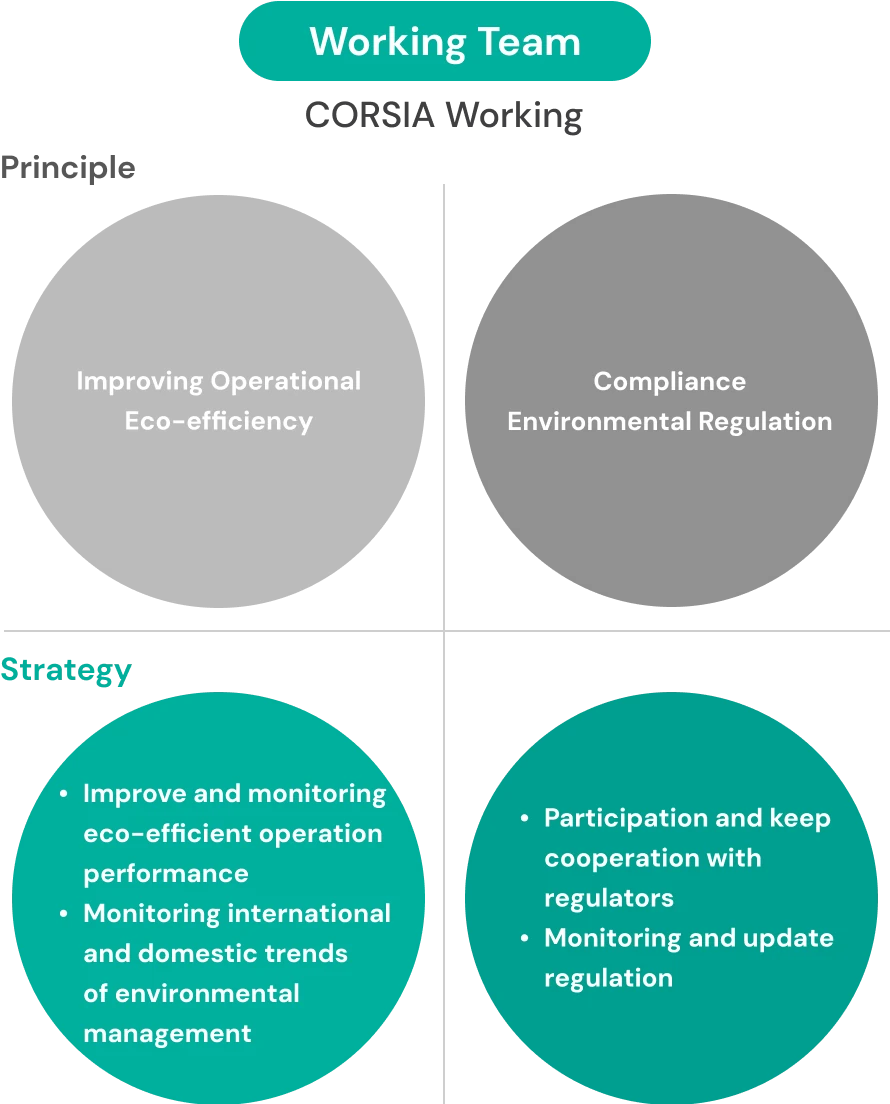

The Company tracked progress in CORSIA eligible carbon emission credits as periodically announced by ICAO. We found that there was a shortage of CORSIA eligible carbon credits in ASEAN this year and market prices were volatile.

Nonetheless, AirAsia Group engaged as an expert in the Committee on Aviation Environmental Protection (CAEP) of ICAO. The participation gave AirAsia Group an overview of the global situation and allowed for the forecasting of carbon credit requirements with reference to its growth by 2030. Conversely, AirAsia Group played a part in supporting its view as an airline and an operator in Southeast Asia, emphasising expected issues from a shortage of CORSIA eligible carbon credits in the region.

AirAsia Group held discussions on the effects of the current shortage of CORSIA eligible carbon credits in ASEAN with senior officials of Thailand’s Department of Climate Change and Environment, Energy Regulatory Commission, and Thailand Greenhouse Gas Management Organisation, proposing developments and presenting the most recent CORSIA forecasts on requirements for aviation carbon credits in the 2024-2026 period. The intent was for the bodies to establish a process for gaining approval to sell carbon offsets for compliance with CORSIA and for CORSIA requirements to be considered as part of the Nationally Determined Contribution (NDC).

Following publication of the 12th ICAO edition of CORSIA eligible emissions units in October 2024, AirAsia Group initiated the drafting of a carbon credit plan matching the latest criteria of the project.

Moreover, towards cooperation with the state, Thai AirAsia appointed a representative to the Aviation Sector Panel on Climate Change established by CAAT so we could indicate our views on the Aviation Sector Energy Conservation and GHG Emission Reduction Action Plan. We also strictly observe related CAAT requirements, such as submitting reports on aviation fuel consumption, GHG emissions, and compliance with aviation sector energy conservation and GHG emission reduction action plan.

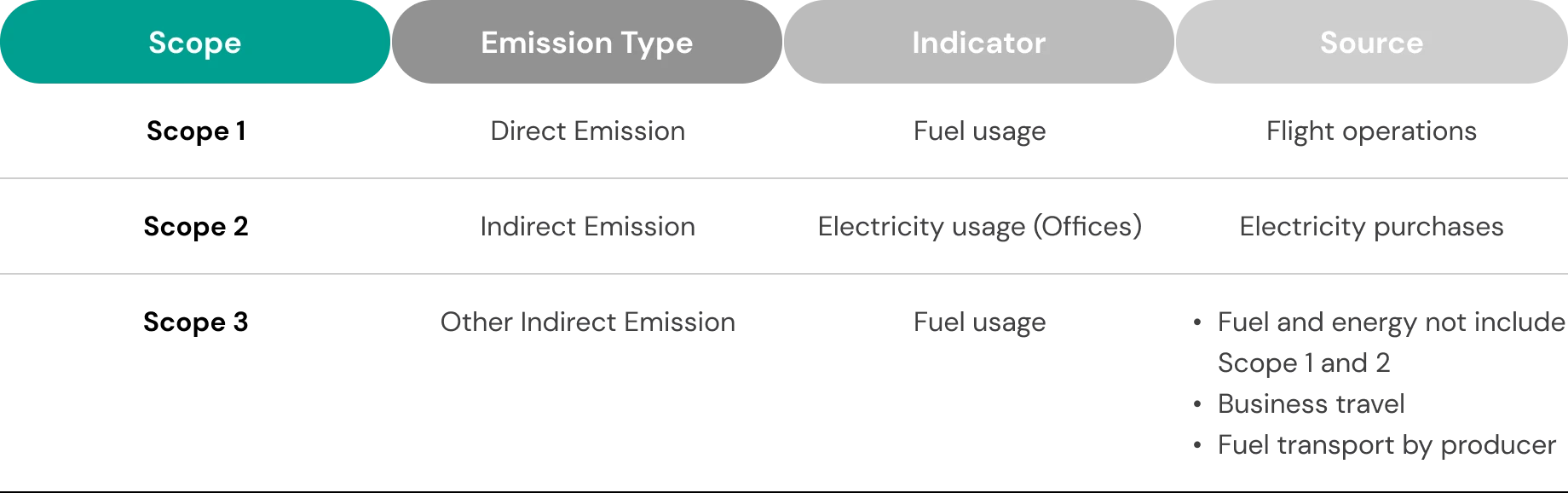

Scope 1 Emissions

| Scope 1 from Flight Operations | 2020 | 2023 | 2024 |

|---|---|---|---|

| Fuel usage (Tonnes) | 209,741 | 453,025 | 501,580 |

| GHG emissions (Tonnes of CO2) | 662,780 | 1,431,561 | 1,584,991 |

The disclosure of Scope 1 emissions by Thai AirAsia does not include ground operations. Fuel usage for flight operations is calculated using the CORSIA Block-On, Block-Off methodology. The Company evaluates GHG emissions in accordance with Thailand Greenhouse Gas Management Organization (TGO) standards and calculates emissions by referencing the ICAO standard Emission Factor. In the future, Thai AirAsia plans to upgrade its transport vehicles and parking devices to electrical operation to further reduce GHG emissions. The Company is studying the feasibility of this aspiration and consulting with future stakeholders.

Scope 2 Emissions

The disclosure of Scope 2 emissions by Thai AirAsia covers emissions associated with energy usage at its Don Mueang hub and AirAsia Academy (other hubs and stations are not included.) Evaluations and estimates of emissions are in accordance with TGO standards

| Scope 2 from Energy Usage at Don Mueang Airport* | 2022 | 2023 | 2024 |

|---|---|---|---|

| Electricity usage (kilowatt hours) | 1,558,989 | 4,003,543 | 4,369,595 |

| GHG emissions (Tonnes of CO2) | 672 | 1,726 | 1,923 |

remark:

For the year 2022 only, the electricity usage shown is only for the Don Mueang office building.

Scope 3 Emissions

The Company began tracking GHG Protocol Scope 3 emissions in 2022. Scope 3 emissions comprise upstream jet fuel production by suppliers and employee business travel. The Company expects to include additional categories as highlighted in the GHG Protocol in the future.

Scope 3 - Category 3 fuel and energy not included in Scope 1 and 2

Scope 3 - Category 6 indirect carbon emissions from business travel and the business travel of employees and management in relation to Company affairs

| Scope 3 from Upstream Jet Fuel Production by Suppliers and Employee Business Travel | 2022 | 2023 | 2024 |

|---|---|---|---|

| GHG emissions (Tonnes of CO2) | 143,191 | 309,122 | 559,788 |

Other Greenhouse Gas Emission

In addition to GHG emissions, the combustion of jet fuel releases nitrogen oxides (NOx), sulphur oxides (SOx), carbon monoxide (CO) and volatile organic compounds that affect the quality of air.

Over the years, improved engine designs have gradually reduced emissions of other GHGs. Under Annex 16, Volume III of its international standards on environmental protection, ICAO has set acceptable levels of emissions from aircraft engines for such gases.

In compliance with these standards, we strive to maintain a young fleet of aircraft that use the latest technologies. As of 2024, all AirAsia aircraft engines meet the most stringent ICAO CAEP/8 NOx emissions standards. As we continue to phase out older aircraft in exchange for new Airbus A321neo models, we aim for 100% compliance with ICAO CAEP/8 NOx standards.

| Other Greenhouse Gas Emissions | 2022 | 2023 | 2024 |

|---|---|---|---|

| NOx emissions (tonnes)1 | 484 | 868 | 657 |

| NOx emissions intensity (gNOx/RPK)1 | 0.062 | 0.043 | 0.03 |

| SOx emissions (tonnes)2 | 53 | 93 | 101 |

| Volatile Organic Compounds (VOC) emissions (tonnes)2 | 183 | 320 | 350 |

remark

- NOx emissions and compliance data are obtained from the ICAO Emissions Bank issue 28C dated 20 July 2021. The NOx emissions value per landing and takeoff (LTO) cycle is based on the weighted average of AirAsia’s fleet composition as of 2024.

- According to the US EPA, SO2 represents the highest composition of SOx emissions, hence SO2 is considered as SOx for the purpose of calculations. SO2 and VOC emissions data are sourced from US EPA’s Generic Aircraft Type Emission Factors table.

Plan for 2025

AirAsia Group expects CORSIA offsetting to take effect in 2025. However, due to uncertainty over state SAF policies, Thai AirAsia may choose carbon credit offsetting to comply with group requirements with AirAsia Group ready to shoulder costs related to the offsetting. Collection of carbon fees on all flights is expected to begin in the second quarter of 2025 as awareness is promoted among the public. For the limiting of financial risks to Thai AirAsia, we have been engaging in negotiations with the government on such carbon fees and expect progress to be made by the middle of 2025.

Additionally, AirAsia Group will be managing overall emissions growth through further investments in renewing its fleet and expanding its operational efficiency programme. The airline group is expected to further reduce its carbon intensity ratio with the addition of 6 additional new A321neo in 2025 and the rollout of its “APU Late Starting before First Flight Departure” programme.

Other developments that can be expected are the expansion of the SAF research partnership between AirAsia Group and Airbus. Thai AirAsia will strengthen our relationship with state agencies and regulatory bodies via the AAT and other public working groups so that we may indicate our perspectives on climate change regulations with the potential to affect the air travel business in the future.

Climate Crisis Management Network